A lot happened over the last month. There was obviously some bad news (as usual) such as hurricanes, intensifying tensions in the Middle East, energy prices rebounding, growing uncertainties surrounding the US elections outcome, or winter coming… However, instead of playing Lou Reed “walk on the wild side”, I decided rather -like equity investors- to focus on the happier or funnier playlist of my own Jukebox with a week holiday in Ibiza, Cagliari Calcio recovering with a win against Parma and a draw vs. Juventus (both games away from home), and an US economy still on track for a soft landing.

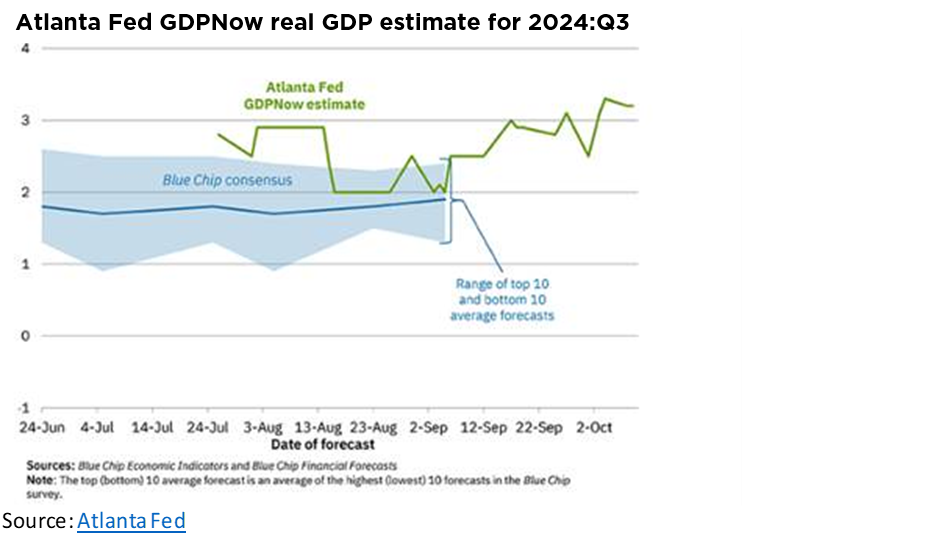

Since Fed’s jumbo rate cut (-50 bps) on 18 September, investors got indeed reassuring economic indicators (despite some ongoing weakness in the industrial sector, services activity and overall consumer spending remain resilient) as illustrated by the pick-up in the Atlanta Fed GDP estimate for the 3rd quarter from 2% to 3.2%, comforting inflation data -especially in Europe- even if US services inflation remains somewhat sticky and, cherry on the cake or a guitar’s solo in a rock song, a surprisingly strong US jobs report, which has definitively muted imminent recession voices. Add to that a global monetary policy easing cycle underway (with the Fed unlocking the ability of other central banks, especially in the EM universe, to cut rates), and, in this context, China’s further policy easing, and in particular the announcement of an upcoming new fiscal package (more about that in the last paragraph of this text, in the “economic calendar” part), and it looks like the perfect Goldilocks’ music to equities investors’ ears with US equity market recording several new all-time high (ATH) recently.

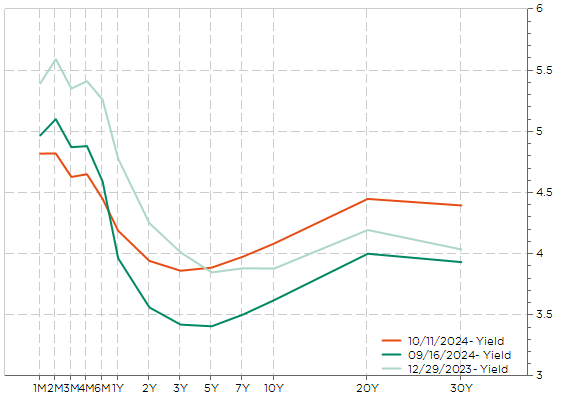

It’s also music to my bond’s investors ears as all this led to important shifts in the bond market and yield curve over the last four weeks, consistent with my own cautious views about duration. The latest US employment data, in particular, caused a relatively significant readjustment of Fed easing expectations. In a soft landing’s base case, the Fed funds rate should be brought back to neutral level around 3.5% by the middle of next year (with two more 25bps cut this year, and 3-4 additional ones in the first half of 2025). In this context, there is a real possibility that the 10y UST yield has already bottomed on 16 September at 3.6% (vs. back again above 4% currently). While unambiguously bad economic data would likely lead to a fast and furious rates rally (and credit spreads widening), the government bonds, and especially US Treasuries, still face potential significant tail-risks headwinds in the near term such as unfavorable US presidential outcome such as a Republican sweep, a spike in inflation/energy prices in the next few months, growth reacceleration on the back of global monetary easing (note that recent overall market actions were symptomatic of a pro-growth / pro-cyclical environment) or supply debt concerns filtering into the long end of the US Treasuries curve.

US yield curve as of end of last year, on 16 Sep 2024 (prior the last FOMC) and today

Anyway, the year is not over yet and both downside and upside risks either on equity and bond markets can’t be dismissed. Many economists expect a recession by next year, while inflation isn’t tamed yet. Just look at the VIX index, the fear gauge, which is currently standing above 20 despite low observed S&P500 volatility in a context of a series of new ATH. That’s quite rare! For sure, the VIX is certainly boosted by the events ahead such as the US presidential election, and to a lesser extent the tensions in the Middle East, but it is also symptomatic of the heightened uncertainties of what really lies ahead of us next year and beyond.

CBOE Volatility Index (VIX): the fear gauge remains at remarkable high level

In this context, it may explain another rare thing we have observed so far this year: a golden record for a safe haven in an overall positive year for most financial assets … Indeed, gold has been outperforming handily stocks this year as it is not only benefitting from the Fed’s anticipated easing cycle but could also prove a better safe haven than sovereign bonds in case of US political turmoil, additional budgetary slippage concerns or a no-landing scenario. Like in music, classics remain timeless.

The legendary DJ and house music producer Kerri Chandler and the bond manager at Ibiza’s airport

Economic Calendar

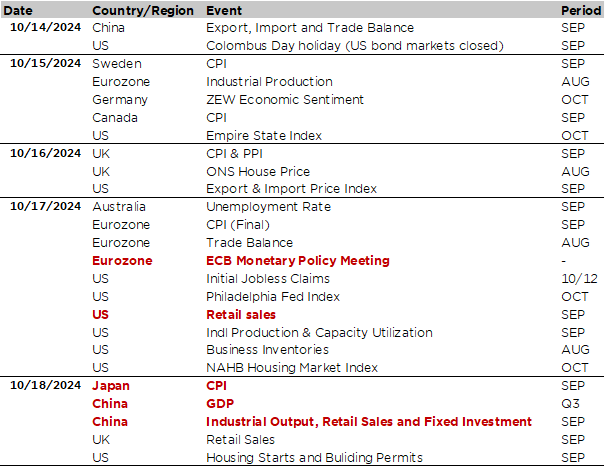

Economic activity, inflation, central banks and earnings releases… there will be something for everyone from every corner of the global economy this week. Among the key releases-events, the US retail sales as well as the ECB meeting (both on Thursday afternoon), but also the latest inflation print in Japan and China Q3 GDP (on Friday) including the monthly economic activity indicators (industrial output, retail sales and fixed investment) for September. Finally, Q3 corporate earnings season will ramp up this week, including several bank results (Charles Schwab, BofA, MS, GS or Bancorp among others), some tech AI-driven semiconductor firms (ASML, TSMC) as well as Netflix and some other well-known S&P500 blue chips such as UnitedHealth, Abbott, J&J or P&G. A non-exhaustive list of major US Q3-2024 earnings releases over the week is provided at the bottom of this text.

Starting with the US, the focus will be on activity indicators for September, including the retail sales print along with industrial production on Thursday to assess the economy’s performance ahead of the Fed’s next meeting on November 7. The consensus expects resilient retail sales growth, picking up from August small gains (+0.1%), while industrial production growth is foreseen at standstill in September after +0.8% the prior month. In addition, we will also get the regional manufacturing indices for September (Empire State index tomorrow and Philadelphia Fed) as first hints about US ISM released on November 1st, as well as housing starts and building permits on Friday. Note that Canada September CPI is due tomorrow (BoC has already cut rate three times by -0.25%, from 5% to 4.25%, since June).

In Europe, the highlight of the week will be the ECB meeting on Thursday. The consensus expects now a 25bps rate cut following recent lower-than-expected inflation prints as well as a continuation of weaker and thus disappointing growth indicators. Note that this cut wasn’t really in the cards about 4-6 weeks ago as the ECB was rather planning to ease by 25bps once every two meetings at that time. Just before the ECB meeting, the final Euro Area CPI reading for September (+1.8%) will be released, while Euro Zone industrial production and German ZEW Economic Sentiment index are also due tomorrow. In the UK, the focus will be on September CPI and PPI (Wednesday) ahead of the next BoE decision on November 7. The headline inflation is expected slowing to 1.8% but the core should settle at 3.4%.

Moving on to Asia, we will get the Japan CPI on Friday. The consensus expects the headline, core (excl fresh foods) and core-core (excl. fresh foods & energy) annual inflation to slow down towards, but still slightly above, 2%. However, China will likely steal the show on the same day with the releases of its Q3 GDP, amid investors mounting doubts its government will reach its 5% growth target this year, as well as the usual monthly economic indicators (retail sales, industrial production and fixed investments) for September.

Yesterday (i.e. on Sunday), China CPI report indicated prices remained unchanged last month, leading to a decrease of the annual inflation to +0.4% from +0.6% in August. China is still flirting with outright deflation as producer prices deflation deepened further, from -1.8% to -2.8% in September, on the back of worsening overcapacity. Once again, the Ministry of Finance didn’t provide concrete details on additional fiscal stimulus this week-end, but it did commit to ramp up fiscal spending in Q4 and hinted at an expansion of the budget deficit next year too. While it should provide some support to domestic demand and therefore help alleviate near-term deflationary pressures, the reality is that key decisions regarding fiscal stimulus are still pending… Perhaps we will know more at the upcoming Standing Committee of the National People’s Congress at the end of the month. Or not if China continues playing the clock.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.