Nine weeks later, summer is ending, kids headed back to school yesterday in Geneva and Italy Serie A 2024/25 season just kicked-off with a good draw of Cagliari Calcio vs. Roma…

The last time I hit the send button for this letter on June 17th, S&P500 was at 5’473 (or circa -1% below last Friday close), Nasdaq a touch higher (about 120 points, or less than 1%, higher than today), HY spreads were marginally lower (-9bps compared to today), while EURCHF was standing at 0.96 vs. 0.95 this morning.

France was potentially on the brink of a major political turmoil, which has ended with a hung parliament, successful Olympic Games considering the beauty of the sites, the public’s enthusiasm and the 64 medals its athlete won during these Games in Paris, but still no Prime Minister appointed yet, while CAC40 is -1.5% lower and French OAT spread with Germany unchanged around 70bps as I type. In the US, Biden accumulated gaffes, Trump narrowly escaped assassination attempt, which boosted temporarily his odds of becoming again President before Joe Biden decided to step out, leaving the Democrat’s candidate nomination to Kamala Harris.

In the meantime, tensions escalated in the Middle-East (what else… unfortunately), while Ukraine invaded Russia (a small part obviously). In Japan, Nikkei closed last week just above 38’000 despite its summer’s rollercoaster ride where it broke a new record high above 42’000 in July before falling from a cliff to 31’000 at the beginning of this month after the BoJ hiked rates (July 31st). Looking at these events and the topsy-turvy summer we just experienced on financial markets, it seems that “everything must change for nothing to change” (a famous sentence pronounced by the late iconic star Alain Delon in Visconti’s “Le Guépard” movie).

Actually, a few things have changed in the macro environment and on the financial markets landscape: Gold hit recently a new record high (in nominal terms) above $2’500 per ounce and it’s up +7% from June 17th, USD has lost some ground (DXY abandoned -3%), US 10y rate has fallen by -30bps since then, from 4.2% to 3.9%, while the Russell 2000 (US small & mid-caps index) has gained +6%. These moves are consistent with an incoming Fed’s rate cut in September on the back of further progress on the disinflation process (confirmed by the two latest monthly US CPI reports) and some weakening signs on the labor market front lately. As a result, the inflation issue faded in the background, giving enough comfort and confidence to cut, especially as it also gave way indirectly to some recession concerns. At this stage, we still foresee a soft landing but we recognize that the downside risks have increased given where are in the cycle. In this context, we expect the Fed to cut by -25bps in September in our soft landing/gradual monetary policy normalization scenario rather than by a -50bps cut to rescue the economy in a hard landing situation.

Anyway, as the timing and the pace of rate cuts will remain data dependent, let’s review and analyze the latest signals we got with a recap of US economic data released last week illustrated by some graphs to get a better perspective.

Basically, the odds of a hard landing scenario have receded last week thanks to the overall good health of US consumers (or at least their intact willingness to spend) confirmed by

- better than expected retail sales (total: +1.0% in July vs. +0.4% expected and -0.2% the prior month, revised down from flat / ex auto & gas: + 0.4% vs. +0.2% expected and +0.8% in June)

- Walmart’s results (guidance increased and reassuring assessment about the US consumers even if there is clearly a trending down in consumer’s spending)

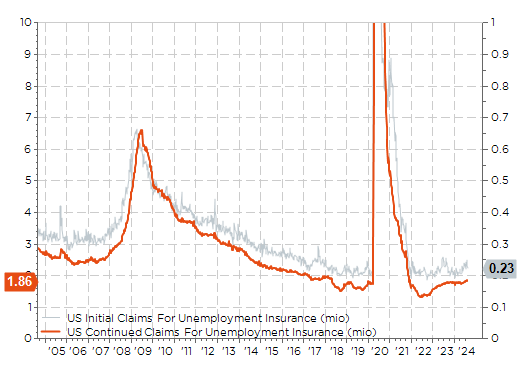

- Jobless claims declining slightly to 227k from 234k, while the consensus expected 235k. Moreover, they still remain close to historical low levels

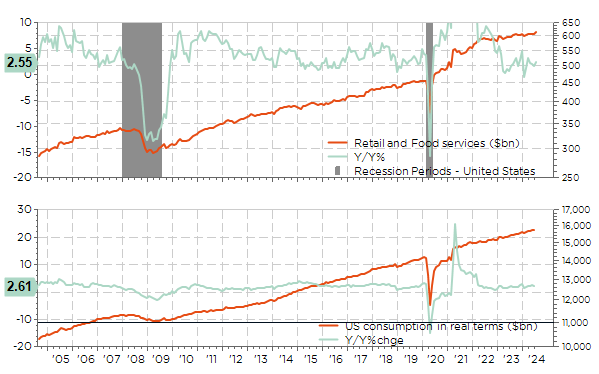

US retail sales (nominal, $bn) and consumption expenditures (real terms), both in level and y/y % change

With US consumption expenditure still growing at a 2-3% a.r. pace, this component will add in between 1.5% to 2.0% contribution to overall GDP. Even in 2008-09 during the GFC, it wasn’t such a drag on total activity. Note also that the recent decline in long US rates -and thus on mortgage rates- has led to a jump in housing refinancing lately. So, as long as the labor market holds, we shouldn’t be too concerned by a marked slowdown in consumption and overall US GDP.

US consumer expenditures breakdown (in real terms): services represent now 65% (or 45% of total US GDP)

Speaking about the labor market, jobless claims are likely the most timely and more robust/precise labor market indicator (people who are allowed for these claims will likely ask for them…). These claims are rising but at a very slow and gradual pace (look at 2007 for example) and they remain at very low historical level overall, especially if you consider that the working population has increased over time. So far, so good even if we obviously remain mindful of the following caveat: the job market is a lagging indicator, i.e. when deterioration will be visible, it may be too late.

US initial (RHS) and continuing (LHS) claims (in mio) for unemployment insurance

However, there was also some food-for-thoughts for those embracing a more pessimistic view on the US growth trajectory thanks to clear signs of weak (eventually weakening further) business cycle on the back of:

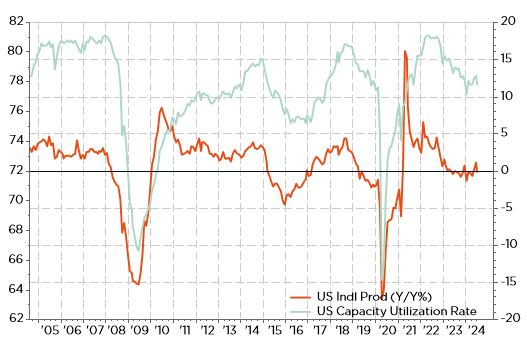

- Below consensus and contracting industrial production (-0.6% in July vs. -0.3% expected and +0.3% the prior month, revised down from +0.6%).

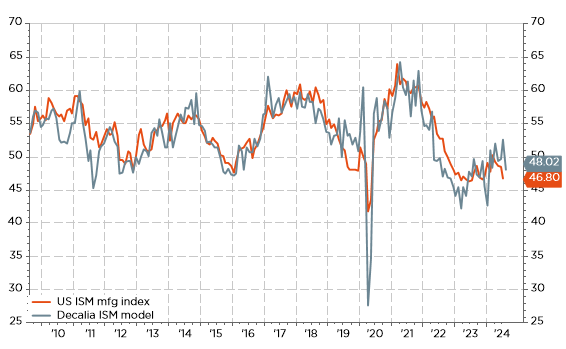

- A sharp decline of the Philadelphia Fed mfg index to -7.0 in August from +13.9 in July, which is dragging down our ISM model back under 50 (see graph below).

US industrial production (y/y % chge, RHS) and capacity utilization rate (LHS)

US manufacturing sector has been running at idle over the last 12 months and capacity utilization rate remains on a downward trend. That’s consistent with the “pessimistic” signals given by the usual business cycle/leading indicators (including the inverted yield curve among others). I repeat myself but I believe these indicators have been distorted this time by the post-covid exceptional boom that followed the not-less-so exceptional bust… They pointed rightly that growth will decline significantly, but as the starting point was much higher than usual, it is taking more time and it will eventually normalize or end slowing at a still acceptable level. In other words, they were/are indicating that current growth was/is still above potential and it will slow going forward (ending in recession most of the time… but perhaps not this time or rather not as soon as we may fear)

ISM mfg model based on Empire State and Philadelphia Fed Index

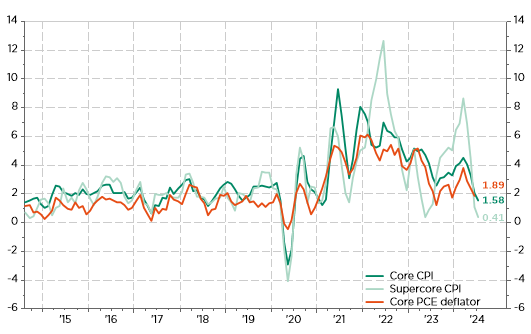

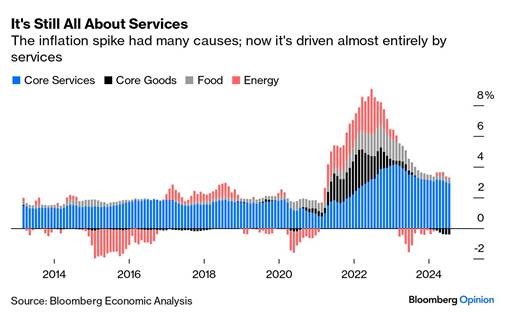

To conclude, just a few words about the last US CPI report, which was basically in line with expectations. It gives a green light for the Fed to cut by -25bps (but not -50bps) considering (1) that recession odds have receded and (2) supercore inflation -related to services is still running too hot for full comfort on the inflation front. Obviously, economic activity and labor market have now moved on the forefront of Fed’s goals but inflation is still not yet that far behind for the time being.

Q/Q% a.r. in core inflation, supercore & core PCE: back on track – over the last 3 months – to give Fed some comfort

Selected US inflation components: Sticky inflation in services

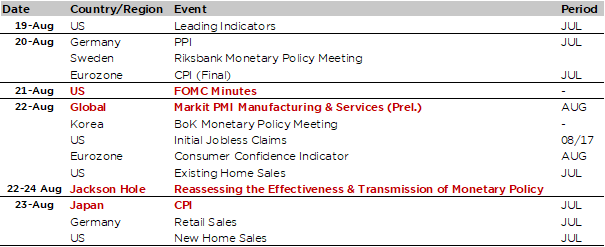

Economic Calendar

Economic calendar

The Jackson Hole annual Economic Symposium, starting on Thursday (and running until Saturday), will undoubtedly by the key highlight of this week. The theme this year is « Reassessing the Effectiveness and Transmission of Monetary Policy « . The happy-few academics and the world central bankers’ gratin will thus discuss about their current tools at hand (i.e. interest rates and balance sheet) and how effective they are in a still more complex and heterogenous economy, analyzing also the (undesired) side effects I hope. Research papers, which will be presented and discussed, aren’t yet available. Fed Chair Powell will be speaking at 4pm Geneva time on Friday and he may thus eventually give some hints about how recent economic data releases have impacted officials views ahead of the next Fed meeting on September 18. The focus will definitively be on central banks next week as the Fed’s FOMC meeting minutes are also due on Wednesday, while Sweden Riksbank will meet on Tuesday (a -25bps rate cut to 3.5% is expected).

As concerns about inflation have now moved in the background, global flash PMI indices on Thursday will be closely scrutinized to gauge the business cycle dynamics: will resilience in services activity continues? Will the manufacturing sector gauge bottom up or fall further? Another timely US labor market gauge to keep an eye on is the weekly jobless claims report released every Thursday in the US.

The only place where inflation still matters from the time being, and thus acts as a troublemaker, is Japan. The consensus expects both the headline and core (ex. food & energy) decreasing to 2.7% and 1.9% respectively in July from 2.8% and 2.2% the prior month.

Briefly turning to politics, note that there will be the Democratic National Convention in Chicago (19-22 August), while in Japan, the schedule for the LDP leadership election should be finalized tomorrow (20 August) following Premier Minister Kishida’s announcement that he would not run in the September LDP presidential election. Finally, in corporate earnings, Target and TJX results will bring more insights on US consumers’ health following the upbeat sentiment after Walmart’s results, while in IT sector, we will get the reports from Palo Alto Networks, Snowflake and Analog Devices among others.

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.