By Alexander Roose, Head of Equities and Portfolio Manager for DECALIA Sustainable strategy

- Market environment : AI driven Equity dominance

- Outlook H2 : Smid-caps prime time? “grand-cru” Equity year

Market Environment

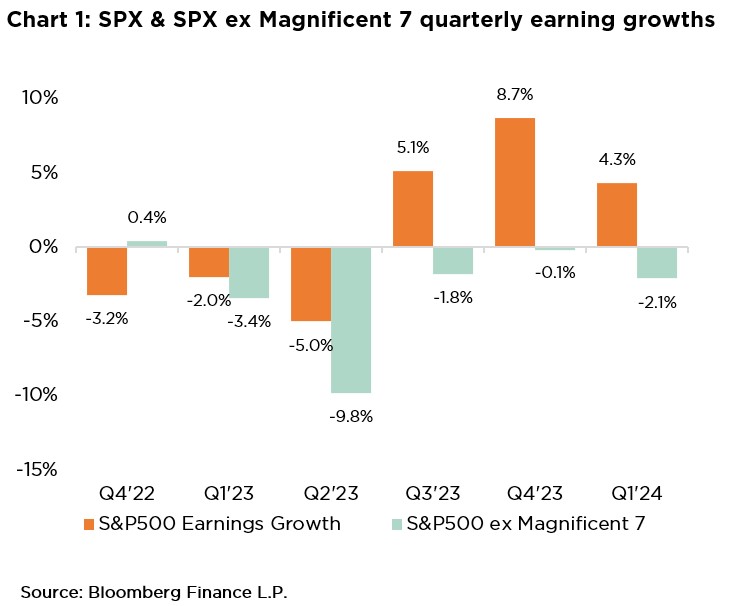

While the final weeks of the first quarter exhibited improved market breadth, the second quarter saw a sharp reversal of that trend. The bellwether S&P500 index clinched a 5% total return (in EUR) during the quarter but the equivalent S&P500 equal weight, S&P400 (midcaps) and Russel2000 indices were all in negative territory, demonstrating the narrow performance breadth and the related dominance of AI/magnificent 7.

On the other side of the Atlantic, Europe also lagged with a notable outlier for the CAC40, for obvious (self-inflicted) reasons. In terms of macro developments, after a couple of unwelcome inflation data releases earlier in the year, inflation prints since May are moving in the right direction, putting a high probability for a Fed cut after the summer (and thus joining other central banks in the start of the rate cutting cycle).

At the same time, economic momentum is losing steam, though not alarming with still robust employment figures, with US unemployment rising tentatively on the back of a higher labor force participation rate. For now, the US market continues to propel higher, helped by the aforementioned super-cycle in AI and the market interpreting worse economic data as good news. Although (geo)political risks are often touted by market participants as a potential source of market derailment, this has not proven – not to our surprise – to be the case over the last couple of quarters/years.

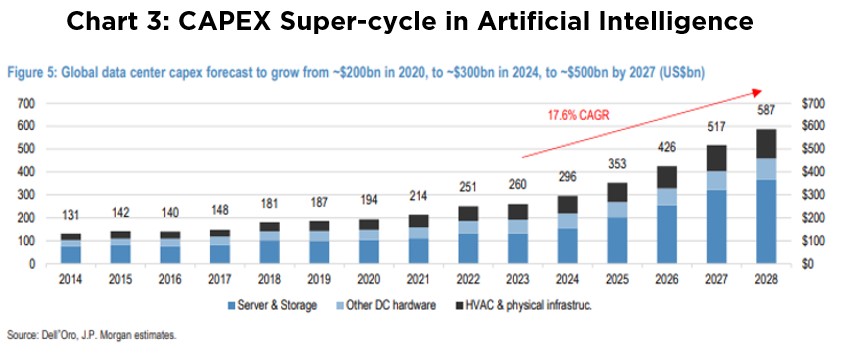

More importantly, the direction of travel for equity markets continues (and, in our opinion, will continue) to be determined by the dominance of AI, given the lengthy capex (super) cycle and notably driven by cash-rich mega-large companies, associated strong earnings momentum and tangible productivity benefits.

Outlook

As previously stated, the US market continues to break record after record (37th all-time high as we write this note), which is – based on historical data – not a catalyst to exit equity markets, quite to the contrary. When it comes to the 2H macro outlook, the key question is if the Fed will be able to engineer a soft landing (both considering inflation & employment data given its dual mandate) or if the recent loss of economic momentum is the first symptom of the lagged impact of monetary tightening and thus indicative of worse things to come.

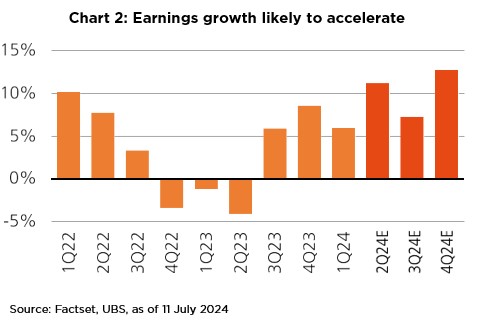

We remain in the first camp and remain outspoken for a ‚grand-cru‘ year in equites, mainly on the back of an underestimated earnings cycle (operating leverage, capex momentum, AI super cycle..), something which has been validated over the last quarterly earnings releases, and on which we have dwelled numerous times.

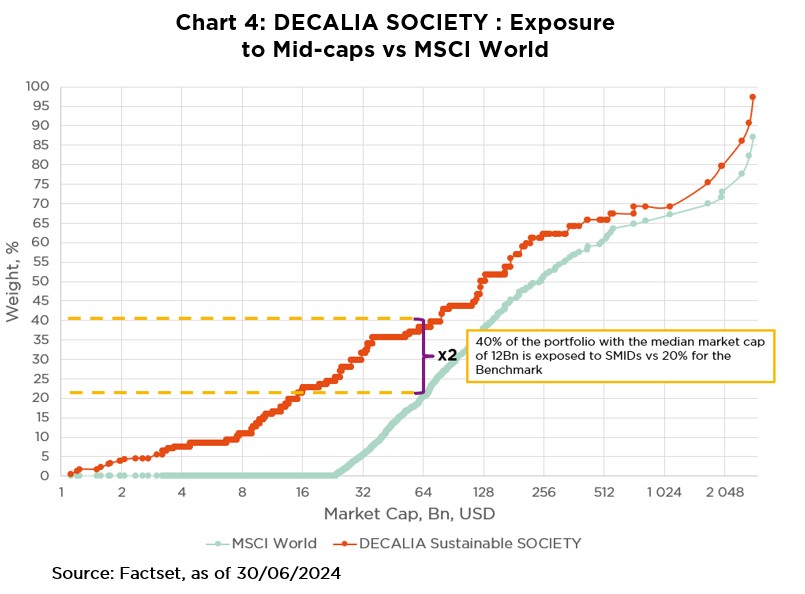

Thus, we repeat what we said in our outlook article published in the beginning of the year: despite the recent market surge and the consensual view of a no/soft landing, we are confident that the remainder of ’24 could still provide upside for equity markets on the back of tangible signs of disinflation (helped further by AI-driven productivity gains), appealing valuation levels (especially but not only limited to the Smidcap space, which should start to see a re-rating in 2H with FED cuts around the corner), accommodative central banks and prospects for solid earnings growth in 2024.

Although markets participants remain mesmerized by interest rates (inhibiting returns for Smidcaps) and when the Fed will start its rate cutting cycle, we are of the opinion that 2H24’ will be a fruitful environment for stock-picking as the tightening cycle has come to an end (and it is more back to fundamentals), although the narrow breadth has proven to be a headwind for many fund managers. We remain convinced of investing through the seven themes (Security, O²&Ecology, Cloud & Digitalization, Industry 5.0, Elder & Wellbeing, TechMed and Young Generation) regrouped by the acronym SOCIETY as a good ‘framework’ to outperform markets over a reasonable time period, something which has been validated over the last in 2023 and 2024.

About the DECALIA Sustainable strategy

Head of Equities

Quirien Lemey

Senior Portfolio Manager

- a multi-thematic global equity fund, investing in innovative sectors and disruptive companies shaping our SOCIETY in the future

- invests in the 7 themes (Security, O2 & Ecology, Cloud & Digitalisation, Industrial 5.0, Elder & Well being, Tech Med, Young Generation) regrouped by the acronym SOCIETY

- managed by an experienced team: Alexander Roose (ex-CIO of the Fundamental Equity of Degroof Petercam AM) & Quirien Lemey (ex-Lead PM of a Multi-thematic fund at Degroof Petercam AM)

About DECALIA SA

Established in 2014, DECALIA SA is a Swiss investment management company. With more than 70 employees and assets under management that stand at €4.9 billion, DECALIA has expanded rapidly, in particular thanks to its active-management experience built up over the last 30 years by its founders. The strategies developed by DECALIA focus on four investment themes deemed promising in the long term: the disintermediation of the banking sector, the search for yield, long-term trends and market inefficiencies. DECALIA is regulated by FINMA through a collective assets manager’s license. In addition to its Geneva headquarter, the group has offices in Zurich, Milan & distributors of the DECALIA Sicav in Spain & Germany.