For those of you who read me regularly, you all know my passion for sports and financial markets. For sure, I would have preferred to make a living from my first passion, but the bar is certainly less high in the second. Anyway, I can’t complain because there are many similarities between the two, which are characterized by a dynamic interplay of predictions, strategies, uncertainties and a final outcome. They both rely on data analysis, human behavior, training and the management of unpredictable variables…

While some outcomes may be easier to forecast in sport (such as who will win the UEFA champion’s league final?… Real Madrid again!) or not (such as Cagliari avoiding to be relegated in Serie B), the trajectory and the scenario of the game remain as uncertain as ever (just referring to the victory of Servette FC in the Swiss Cup yesterday after an epic penalties’ session). Whatever the case, emotions are always running high at the end. Same could be said about US monetary policy currently as we all know that the Fed will cut rates at some point but the timing and the extent of easing remain unclear. Moreover, we still don’t know if financial markets will celebrate it (if it means Fed has won its fight against inflation) or just cry in case of a recession. For the time being, a resilient economy, a still-strong, if softening labor market, and an elevated inflation argue against the need for an imminent Fed’s rate cut.

Speaking about inflation, which is the topic at hand today, we are getting close to… hyperinflation as far as sports fans are concerned given the many events lying ahead of us in the next few weeks: Roland Garros, NHL playoffs, Euro 2024, Paris Olympic Games in Paris, NBA finals starting on Thursday night and, of course, the FIMBA MaxiBasket European Championship in Pesaro at the end of the month where I’ll be defending, with my great “over 50 years old” team mates, the colors of Switzerland.

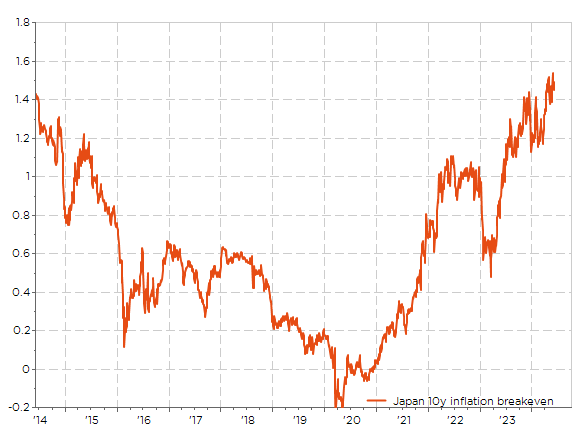

In the meantime, inflation is still stealing the show on the markets: latest US CPI and April PCE deflator data, which was released on Friday, came basically in line with expectations: headline and core PCE rose +0.3% and +0.2% MoM respectively, and +2.7% and +2.8% on YoY basis, as expected. They offered some welcome relief on financial markets, especially on the global bond’s markets after a challenging (read volatile) start of the year on rates. Elsewhere the inflation story has been a touch more concerning lately with data surprising on the upside in Australia, UK and Euro Area more recently. The Euro Zone flash CPI prints for May came indeed above expectations last week at +2.6% year-on-year for the headline (vs. +2.5% expected) and at +2.9% for the core index (vs. +2.7% expected). As a result, it casted some doubt on how aggressively the ECB will cut over the next months, even if the data weren’t bad enough to call into question the first ECB rate cut widely expected for this Thursday (see our economic calendar section here below). Even in Japan, inflation expectations are peaking up on the back of a weak currency and the latest shunto results where Japan’s unions have managed to negotiate a +5.2% wage increase, the highest in over 30 year, while the BoJ remains deliberately behind the curve.

The little beast that goes up and up… Inflation is even showing its face in Japan

Turning back to the US, investors have been surprised by the current bumpy disinflation trend over the last 12 months. While the vast majority -including the Fed – was convinced that inflation was cooling off at the end of last year, there are now some doubts about if this trend will continue (or eventually revert as if has been the case in the first months of this year), how much (will inflation fall back towards the 2% threshold grail) and how fast. As illustrated here below, the annualized rate of the last 3M change of some Fed’s favorite inflation gauges, namely the US core inflation, the supercore inflation (stripping out the goods and the rent-owner/housing components, on top of food and energy) and core PCE deflator, inflation is still too high for comfort… after a false sign of joy, or like a feint in sport, at the end of last year when these indicators were running below 2%.

Still too high for comfort: Q/Q % chge annual. rate in core inflation, supercore inflation & core PCE

So, these latest inflation data, combined with those on activity and labor market, take a first Fed’s rate cut this summer off the table, barring an exceptionally swift U-turn or an external shock. The September meeting remains “live” (Fed fund futures point to a 50% probability) but again, it will depend on the incoming data (in this context, let’s keep an eye on US jobs report for May on Friday to start with). For the rest, I am still doubting about the ability of the Fed to ease soon and/or significantly for the following reasons.

First, very basically, the year-on-year base effects will now turn unfavorable and thus making further annual rate downward progression harder. The US inflation increased by +0.1% in May 2023, +0.2% in both June and July of last year. The core PCE deflator rose even less over the same period (+0.1% in May, +0.2% in June and +0.1% in July 2023), not to mention the supercore inflation, which even declined -0.1% in May and then posted 2 consecutive +0.2% moderate gains. If inflation increases at a faster pace during the same months this year, the inflation rate will rise year over year on all these gauges.

Then, because I still believe that US monetary policy hasn’t been as restrictive as we thought at the beginning. At the opposite, as it has even remained too accommodative for too long and it is perhaps still not tight enough currently to really slow down economic activity or lead to a (managed/more or less under control) cooling of the labor market, the landing takes much more time with US economic expansion still running close or slightly above the potential growth rate. Another way to look at it, it’s considering the cumulative effect of inflation. Prices may be rising more slowly, but they’re still higher than they were and certainly not falling! Fed and investors may declare inflation is over in a few months when it will drop back to 2%, but households and companies will still pay more than 20% for everything they need compared to prior the Covid… barring a bout of deflation (which nobody wants neither!)

Catch me if you can!: Selected US inflation gauges and 1-3M T-Bills Total Return

In addition, monetary policy have certainly had less or little effect this time due to loose fiscal policy (deficit at 6% of GDP), less sensitivity to higher rates among homeowners and corporates as they refinanced at incredibly “cheap” conditions, especially in real terms with the rearview mirror, before 2022, and the many structural geopolitical challenges the economy is facing where prices aren’t the main signal or issue (onshoring, security spending, sustainability through “greenification”). Not to mention the Magnificient 7 and the AI revolution, a growing part of the economy, which is quite insulated from change in interest rates for his business (even if it could be a different story for its market’s valuation).

Last but not the least, if you think inflation is cooling? Think again. That’s the message from David Ranson in one of the latest Barron’s edition (24 May). David is the head of HCWE (a forecasting consultancy based in Portland), with whom I have the great privilege of exchanging views on a regular basis. In one of its latest paper research (“Inflation is mostly a simple tale of two commodities”) cited thus in the Barron’s, David shows that the prices of just two pivotal commodities, gold and oil, suffice to explain the inflation rate nearly completely (actually producer prices initially). And the interpretation is just as straightforward: according to its basic but rather efficient modeling, inflation isn’t cooling off in the near term. While David has worked with annual data (change in gold and oil prices the previous year, explaining the produces prices trajectory this year), I have rebuilt it here below for your eyes only with coincident monthly data taking the CPI instead of the PPI, and oil & gold prices YoY changes deflated by a constant number in order to fit in the graph. It’s not perfect but trends and levels also give valuable information.

A simple model for inflation trend: not going down

So, if the next round of data doesn’t cooperate soon enough, the next Fed’s meeting is then scheduled on 6 November… the day after the US Presidential Election. Likely among the biggest uncertainty for the 2nd part of the year with plenty of risks to the growth, inflation, and the Fed outlook from the results. So, December may eventually be the last opportunity for a rate cut this year.

As I just have traded my crystal ball for a pair of flying-high-in the air sneakers, I won’t commit too much on any predictions but we can all recognize that (1) inflation is both better than it was and higher than it should be and (2) it will likely take some time before the fight against inflation is really over. In this context, we can’t dismiss to wait until next year before the Fed ease monetary policy. Patience is certainly a virtue that will be rewarded at some point. Trying to curb inflation faster or declaring victory too soon could prove self-defeating as it could lead to a recession or even outright deflation/depression in the end-game.

Same could be said for me regarding the virtue of the patience, is not it? First, I had to wait until I got 50 years before playing basket-ball at an international level, then, for a bond’s veteran like me, the outlook for fixed income portfolios has brightened significantly compared to the last decade. Unfortunately, both haven’t really paid off well so far: I can’t still make a living of my sport’s passion, whereas bond’s returns have been lackluster this year. However, even if long rates don’t offer yet perhaps a sufficient valuation opportunity due to sticky inflation, higher for longer (neutral) rates, as well as sovereign debt sustainability concerns, I already know that the embedded carry will at least shield the bond’s portfolios I manage from any significant misfortune going forward.

Concluding this long letter with a slightly adapted version of the Olympic motto, I may say “being there is everything, even if winning is better”. Just a question of time, working hard to stay in the game and luck to a certain extent.

Economic Calendar

Welcome to June! As every first week of the month, investors focus will be on the US jobs report (Friday), the PMI indices for the major economies and the US ISM gauges (manufacturing on Monday and services on Wednesday). Moreover, the key macro event in Europe will be the ECB’s meeting on Thursday with investors widely expecting a 25bps policy rate cut as it has been more or less explicitly guided by ECB members over the last few weeks. The Bank of Canada will also meet on Wednesday and likely cut its target rate to 4.75% from 5% according to the consensus.

Speaking about central banks, the next Fed meeting is scheduled on 12 June and, ahead of the Fed’s decision, this week US job report will be a key event for markets as uncertainty still persists about the timing of US rate cuts. However, the consensus doesn’t expect any meaningful surprises embedded in this report or big changes compared to the prior month as it foresees unemployment rate remaining stable at 3.9%, payroll gains of +180k in May vs. +175k in April and a small uptick in average hourly earnings to +0.3% MoM from +0.2%. Before this release on Friday, we will get the JOLTS (Tuesday) and ADP (Wednesday) reports for April and May respectively, as well as latest weekly initial and continuing jobless claims (Thursday).

In this uncertain context regarding the trajectory of US policy rate, investors will also pay attention to the ISM indices prints for May, especially when it comes to prices paid, new orders, inventories and employment components to assess inflation risks and activity trends. According to the Bloomberg consensus, both the manufacturing and service gauges are expected moving slightly higher in May while remaining around the expansion-contraction threshold of 50.

Turning back to Europe, other notable economic releases this week include German factory orders (Thursday) and industrial production (Friday), Eurozone retail sales on Thursday and Swiss CPI for May (tomorrow) ahead of the next SNB meeting on 20 June. In politics, the focus will be on elections for the European Parliament (6-9 June). Moving to Asia, the few key indicators due are personal income and spending in Japan on top of the first shunto results, China Caixin PMI indices and May trade data. Elsewhere, there will be Q1 GDP data in Australia (Wednesday), Brazil and South Africa (Tuesday).

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.