At the time this letter will hit your screen I will be on holiday. While I will obviously enjoy it and benefit fully from my days off treat, I am somewhat concerned about the many tricks that markets may play to frighten investors during my absence as a busy data-packed week await us.

In the meantime, my vacation took off like a firework as I just arrived in time at Cagliari to attend the remontada tricks of Cagliari Calcio yesterday… from 0-3 to 4-3 in the last 25 minutes with two goals from Leonardo Pavoletti after the regulatory time. Thanks to this small miracle, the threat of relegation has somewhat diminished for my favorite squadra. And to top it all off, I met the day’s hero in person… What a treat!

Il Bomber (Leonardo Pavoletti) and the bond manager at Palazzo Doglio yesterday evening

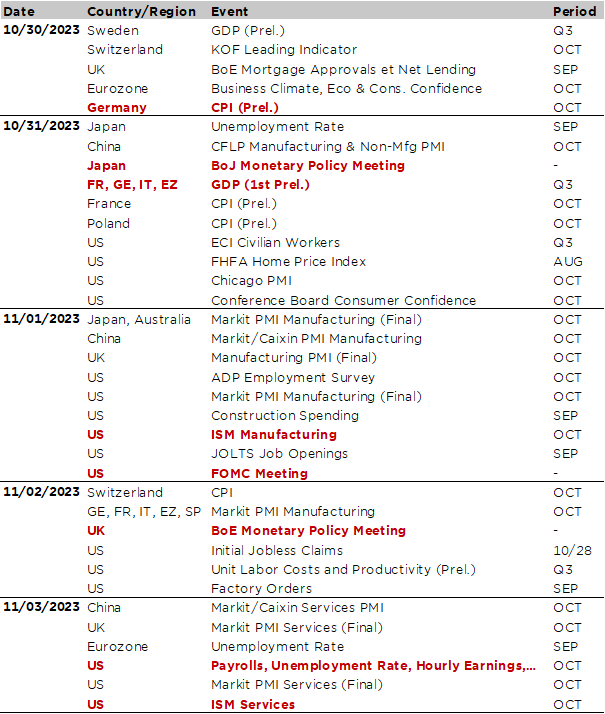

Turning to markets, investors’ attention will be laser-focused on central bank decisions, including the BoJ tomorrow, the Fed on Wednesday and the BoE on Thursday, while also keeping an eye on several key macro releases such as the US ISM indices on Wednesday (manufacturing) and Friday (services), the US jobs report on Friday, as well as flash CPI & GDP releases in Europe tomorrow or China PMI indices on Tuesday and Wednesday. Last but not the least, the Q3 earnings season will continue running at full speed with the results releases of Apple, Qualcomm, Pfizer, Eli Lilly, Novo Nordisk, Toyota, McDo or Shell among others.

Whereas both the Fed and the BoE are widely expected to stay pat, keeping rates unchanged at 5.50% (upper bound) and 5.25% respectively (at the unanimity for the Fed but with a split vote for the BoE), the BoJ may abandon or lift the 1% cap on its Yield Curve Control if it fits into its updated economic projections, which should then show they now expect inflation to remain at or slightly above 2% in the forecastable future (read 2024 and 2025). It remains nevertheless a close call: if BoJ removes it, it could have meaningful impact on markets especially on the JPY carry trade, which will likely reverse, as well as on many DM markets bonds, which should sell off, as well as some not-so-nice-neither ripple effects on equities and credit as Japanese investors may be tempted to repatriate their investments. Note that the BoJ may eventually hike policy rates out of negative territory before removing the cap, but that would be a surprise. In the not so improbable case of BoJ continuing to kick the can down on the road by maintaining the status quo, further JPY weakness has to be expected (perhaps contained by some fx intervention) but the relief may be short-lived if global/Japan economy remains resilient, inflation sticky and upward pressures on rates intensify. In other words, YCC will come under further pressure as expectations of policy normalization build up.

As far as the Fed meeting on Wednesday is concerned, the central bank is expected to keep rates unchanged. It has indeed probably hit the terminal rate as the hurdle for another hike is high from now. Anyway, Jay Powell will likely repeat that there are now data dependent, leaving the door open for some marginal adjustment if needed depending of the path of the economy, inflation trajectory and the overall financial conditions. As a result, the baseline is for rates to stay at 5.25-5.5% through year end, with a small upside risks if economy doesn’t slow and/or inflation rebounds.

In this context, the US labor market indicators will be closely watched, including the jobs report on Friday as well as the ADP and JOLTS releases on Wednesday. The consensus expects a gain of about +150-200k in payrolls this month, after a booming +336k in September, unemployment rate to remain unchanged at 3.7% (a historically low level) and hourly wages growth rate staying at +0.2%. In case of a much stronger than expected October jobs report, especially if wages growth reaccelerates and unemployment rate ticks down with another stronger payrolls print, I let you imagine markets reaction… It could be a scary trick after Fed’s treat!

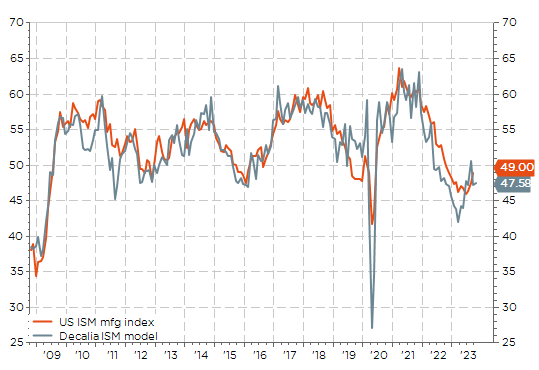

In addition to the US labor market gauges, we will also get the ISM indices, with the release of the manufacturing index on Wednesday and the services one on Friday. The consensus expects the manufacturing index to remain broadly unchanged around 49, but it foresees a decline in the services index to about 52 vs 53.6 the prior month. New orders, employment and price components will likely be scrutinized too in the spotlight. On the consumer side, there will also be the release of the Conference Board’s consumer confidence index tomorrow.

Our US ISM manufacturing model points to a stabilization just below 50

Turning to Europe, the key releases of the week include the flash October CPI and Q3 GDP report. The data will be out for Germany today, followed by France, Italy and the Eurozone tomorrow. Inflation is expected to decline further with headline approaching 3%, while core goes closer to 4%. GDP figures should be consistent with anemic growth overall, but we can’t rule out more disappointing news from Germany, which continues to trail behind.

In China, investors will focus on the PMIs released throughout the week, including the official gauges tomorrow, in the hope of further tentative signs of stabilization/improvements as Chinese authorities continue to pump some support in order for the economy to turn the corner. In this context, Chinese officials may unveil a new trick in order to get rid of real estate turmoil as they gather for the National Financial Work Conference this week.

Last but not least, many companies will also deliver tricks or treats to their shareholders as they released their Q3 earnings results, including Apple, Qualcomm, Pfizer, Eli Lilly, Novo Nordisk, Toyota, McDo, BP or Shell among others.

This letter will resume on Monday 13 November.

Economic Calendar

Non-exhaustive list of 2023-Q3 major earnings releases over the week

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.