- Post-Covid, the western world is looking to secure – and reshore – drug procurement

- Reluctant to build expensive plants, developers are increasingly relying on CDMOs

- More efficient factories & faster production: the case for outsourcing is compelling

After the empty supermarket shelves of the Covid days, it is now pharmacies that are struggling to procure even the most common cold and flu medicines, as many an anxious parent has no doubt experienced. Unusually high seasonal demand is playing a role, but the bigger issues clearly lie on the production side. Pressured by regulatory authorities – eager to better secure and diversify supply chains – and recognising the capex intensity of drug manufacturing, large pharmaceuticals companies are increasingly turning to outsourcing.

Contract Development & Manufacturing Organisations (CDMOs) bring cost-efficiency to the commercial production of drug substances, thanks notably to an average plant utilisation rate of 80-90% (vs. 50-60% for pharmaceutical companies). Such optimisation of the factory space is particularly important within the ongoing drive to re-shore production, as the cost of building plants – and of labour – is higher in the US/Europe, relative to Asia.

The 100+ per annum regulatory inspections that biomanufacturing plants usually undergo also represents a burden for pharmaceutical companies that cover the entire value chain, from drug discovery to commercialisation. Many are thus seeking potentially better value-creating uses for their capital, be it in R&D or M&A, rather than building another large-scale manufacturing facility.

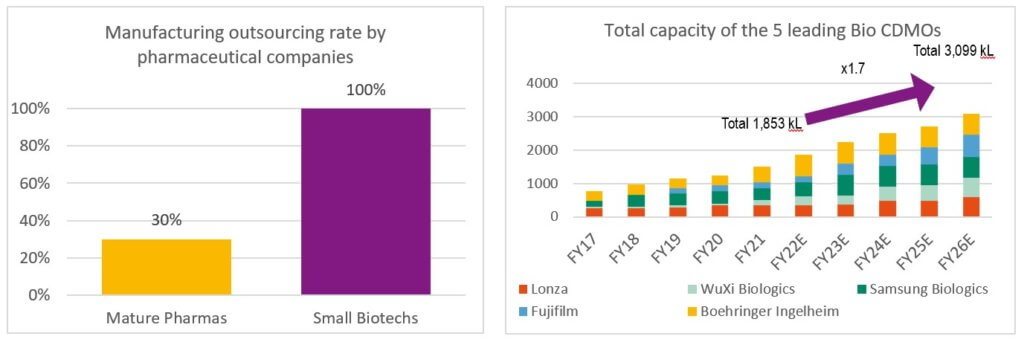

Also playing into the hands of CDMOs is the fact that a growing number of novel modalities (cell & gene and RNA therapies etc.) are nowadays developed by smaller biotech companies, that typically outsource the manufacturing process given the very low probability of reaching FDA approval (1 in 250 compounds only).

This increasing demand for outsourced drug manufacturing has led to a shortage of CDMO capacity, such that all the actors in this space have embarked on multi-year expansion plans. Solely based on what has already been announced, the capacity of the five leading CDMOs is to grow by 70% through 2026! While this already has the market worrying about potential future overcapacity, the risk for an individual CDMO depends on its business model.

It can either start building a plant (a 2- to 3-year endeavour, for an average cost of USD 1bn) while concurrently work at developing a pipeline of contracts, an approach – followed notably by Samsung Biologics and FujiFilm – that entails a higher risk of stale capacity and low utilisation. Or it can first secure an anchor investor, meaning a drug developer that reserves at least 60-70% of the future plant’s capacity, and then only initiate the building phase – for a lower risk of overcapacity and low utilisation.

The CDMO universe comprises both large diversified companies, able to manufacture different drug modalities (ranging from the more traditional monoclonal antibodies to highly complex cell & gene therapies), and smaller niche players that specialise in one type of drugs. Within the former group, the example of Lonza is worth mentioning. Thanks to its strong experience, it was able to set up the manufacturing of Moderna’s mRNA vaccine in just three months, compared to a usual 12- to 24-month timeline. And as far as niche players go, CDMOs such as Bachem or PolyPeptide, that specialise in peptide drugs mainly, also seem headed for strong growth. Peptides are used mainly to treat diabetes and obesity, rapidly expanding markets.

Overall, compared to 20 years ago, we now have a wide range of drug modalities, and each modality may require significant innovation in manufacturing processes. The outsourcing rate from the pharmaceutical industry to CDMOs is thus set to rise.

Written by Iana Perova, Equity Analyst

The road is not yet clear…

- Forget about immaculate disinflation, the labour market is still too tight

- Most financial assets are likely “stuck in the middle”, with downside for risk assets

- Amid this uncertainty and demanding valuations, cash is an attractive yielding shelter

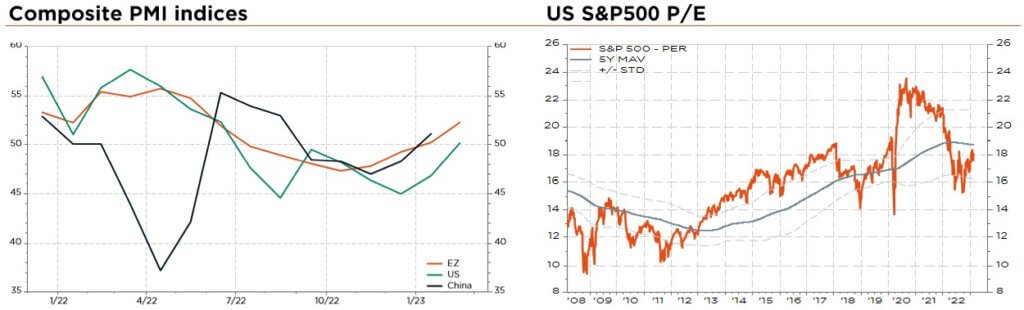

Markets have not really had a love affair since the US CPI was released on Valentine’s Day, then followed by stronger than expected activity indicators. Sticky inflation and surprisingly resilient growth led to a rebound in global rates, as investors raised their terminal rate forecasts and postponed their call for the much-awaited Fed pivot. As a result, the narrative has fast evolved from a goldilocks soft landing and immaculate disinflation scenario to a less supportive one of higher rates and no-landing… until something breaks.

In the meantime, most financial assets are likely “stuck in the middle”, notably rates, credit, equity markets and currencies. Equity valuations, especially in the US, are capped by higher rates, while earnings growth will be lacklustre at best, on the back of modest sales growth and ongoing profit margin compression. Looking forward, both equities and credit still face downside risk in the scenario whereby the Fed is somewhat forced to overdeliver, pushing the economy into recession in order to tame inflation. The same goes for rates: while the current backdrop of stickier inflation, higher terminal rates and more resilient than expected growth is exerting upward pressure, should this all end in tears with a recession, then long rates may back down.

We thus continue to believe that this year will again prove challenging, with still non-negligible risks of recession in US or Europe, as well as stickier inflation in the second half of this year. While we still presume a soft-landing economic scenario, the time sequence of falling inflation and slowing growth remains crucial, uncomfortably leaving equity markets at the mercy of further “tightening” policy decisions. In this uncertain context, a strong case is building to move from TINA (There Is No Alternative) to TATA (T-Bills Are The Alternative). The now 5% yielding T-Bills (and 3% Bubills in EUR) may indeed be considered as a decent shelter, while waiting for clouds to dissipate. And the more expensive risk assets become, the more investors (at least the less greedy ones) will be tempted to take shelter in T-Bills… especially if their yield keeps mounting.

As such, we retain our cautious tactical stance (slight underweight) on both equities and bonds, accounting for positive real rates, a higher risk and inflation premium, the emergence of a new “world order” compared to the past decade and the advent of new reasonably valued low risk investment alternatives, with all these pieces involving consequent rebalancing moves.

Obviously, mid- to long-term equity upside remains, especially in specific areas where investors are still cautiously positioned or underweight and valuation multiples have either improved or remained cheap, providing a favourable asymmetry with above-average medium-term upside potential. In the meantime, we maintain an overall slight underweight stance, via a balanced multi-style all-terrain approach to portfolio construction, and a well-diversified, high-quality defensive equity allocation/selection. At the margin, depending on market conditions and sentiment, which sometimes swings rapidly from fear to greed, we may implement strategies that benefit from excessively high or low volatility (tactical hedging).

In fixed income, we still favour cash instruments (over bonds) and the short end of the curve globally, given the currently inverted yield curve. As far as duration is concerned, we nonetheless favour US Treasuries over other sovereign bonds. They will prove the best safe haven if nominal growth peters out. Finally, we prefer corporates to sovereigns, especially in Europe where valuations remain cheaper than in the US.

Elsewhere, we keep our tactical slight underweight on commodities and gold, the latter’s upside being capped by the Fed’s willingness to restore its inflation-control credibility and its diversifying effect now increasingly challenged by a simpler, less volatile and better yielding alternative… cash.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies