- In American soccer, a fumble is any act, other than a pass or kick, which results in a loss of player possession. I fear that bull investors may soon lose the ball possession in favor of the bears…

- You can’t have your cake and eat it: either growth slows down materially triggering the much-awaited Fed’s pivot, or… growth remains resilient enough and the odds of Fed’s rate cuts are negligible this year

- Because when inflation is the main risk, an extra-insurance central bank will take: The mistake the FOMC must avoid is to cut rates prematurely and then have inflation flare back up again. That would be a costly error, so the move to cut rates should only be taken once we are convinced that we have truly defeated inflation

- There are several evidences that the US jobs market remains still incredibly tight, providing scope for more Fed’s hawkishness than currently priced in.

- Don’t misunderstand me: I am not predicting an equity (and/or a bond) market crash… I just expect trading ranges for both (long) bonds and (US) equities. In this context, cash could be king for a 2nd consecutive year.

Yesterday night, the Philadelphia Eagles and the Kansas City Chiefs of Patrick Mahomes won their ticket to the Super Bowl LVII (NFL -American football league- final) by beating the San Francisco 49ers and the Cincinnati Bengals respectively. The Super Bowl will take place on February 12th, in Phoenix, with Rihanna taking care of the always spectacular halftime show. Among the key play action in the Eagles-49ers game yesterday, there was a fumble of the 49ers quarterback at the end of the 2nd quarter, which then offered an “easy” touchdown to the Philadelphia Eagles just before the half-time. For the uninitiated, a fumble is any act, other than a pass or kick, which results in a loss of player possession.

After the strong start of the year so far for both equity and bond bull investors, I fear that they may soon lose the ball possession in favor of the bears… The fumble may already happen this week given the heavy economic agenda and the large number of major companies reporting their Q4 earnings’ results (see below). Why? Basically, because you can’t have your cake and eat it… Either growth slows down materially leading to a recession severe enough to push unemployment rate (significantly) higher and kill definitively any inflationary menace, which will then trigger the much-awaited Fed’s pivot, or… growth remains resilient enough and the odds of Fed’s rate cuts are negligible this year given the underlying inflationary pressures on the back of a tight labor market.

To convince the reader, here are the conclusions of a recent paper of the Fed of Minneapolis (Why We Missed On Inflation, and Implications for Monetary Policy Going Forward): “The mistake the FOMC must avoid is to cut rates prematurely and then have inflation flare back up again. That would be a costly error, so the move to cut rates should only be taken once we are convinced that we have truly defeated inflation”. In other words, the Fed will take an extra-insurance against the inflation risk, preferring to ease too late rather than too early,… which is exactly the opposite posture the Fed adopted back at the turn of the 2000’s when deflation risks were dominating (Preventing Deflation: Lessons from Japan’s Experience in the 1990s). For those not old or seasoned enough, the Fed cut rate an extra-time on June 2003 from 1.25% to 1.00% when some green shots were already in the air.

As a result, I definitively remain on the “hawkish hold” camp and thus I am still concerned by the overall relative and historically high valuation of US equities. Obviously, US equities current valuation looks cheap if you just consider the last decade when cash and bond yields were negligible globally, but that’s not the case anymore. Assuming a 4% risk-free rate in USD for the next 2-3 years leaves therefore little room of multiple appreciation for the SP500 with a current P/E of close to 20 (i.e. 5% equity yield) and 1.7% of dividend yield. Especially as you can’t rely currently on earnings growth to propel US equity indices higher. In other words, the upside seems capped in my view.

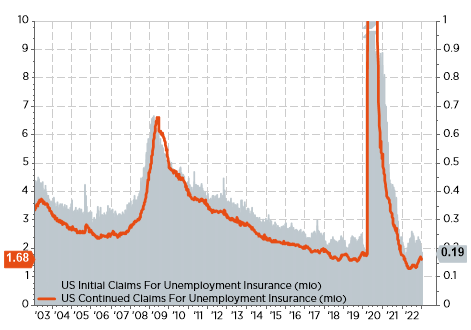

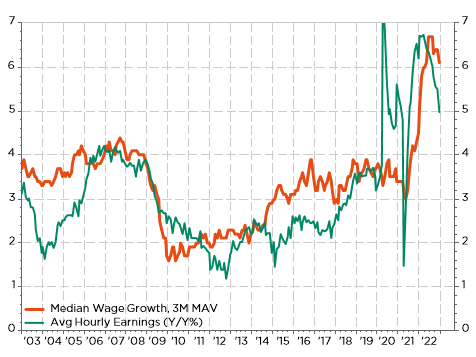

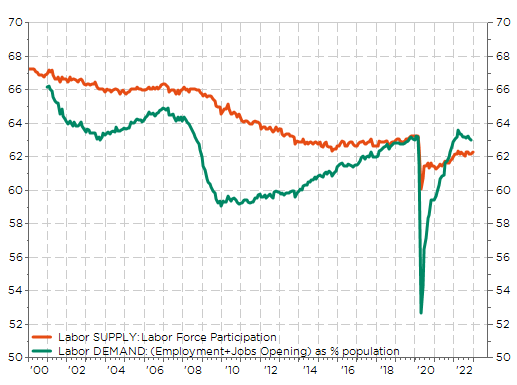

Here are several evidences that the US jobs market remains still incredibly tight, providing scope for more Fed’s hawkishness than currently priced in for H2:

- Weekly initial jobless claims (& continued claims), one of the most timely labor market indicator, has fallen back close to historical low

- The recent decline in the average wage growth, which was interpreted as an evidence of easing inflationary pressures last month, was in fact due essentially to a change in the mix of workers pool… as the median has barely moved! Same phenomena happened in 2020 during the pandemic, when “low wage” employment was cut more drastically

- Jobs demand (total employment + jobs opening) still exceeds supply (measured by the labor force participation)

So far, the Fed has achieved to slow economic growth below potential, but the labor market remains too tight (jobs openings haven decreased enough, participation rate hasn’t increased much, or… payrolls haven’t decreased yet) with wages growth still too high to claim victory on inflation. I don’t believe in “immaculate disinflation” and neither does the Fed: “Even with the recent moderation, inflation remains high, and policy will need to be sufficiently restrictive for some time to make sure inflation returns to 2%” (Brainard). So, forget about a Fed’s pivot in H2. Or price in a more severe economic slowdown. Don’t misunderstand me: I am not Dr Doom & Gloom predicting an equity (and/or a bond) market crash! I just expect trading ranges for both (long) bonds and (US) equities: they will both experience a zig-zag year without going anywhere and cash could be king for a 2nd year in a row. Given markets have zigged so far this year, we shouldn’t be surprised by a fumble from the zag’s team soon.

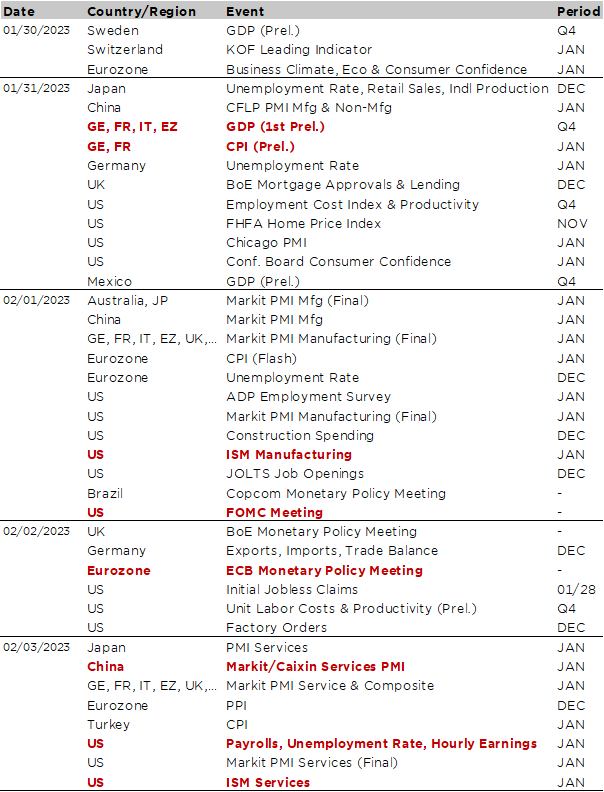

Economic calendar

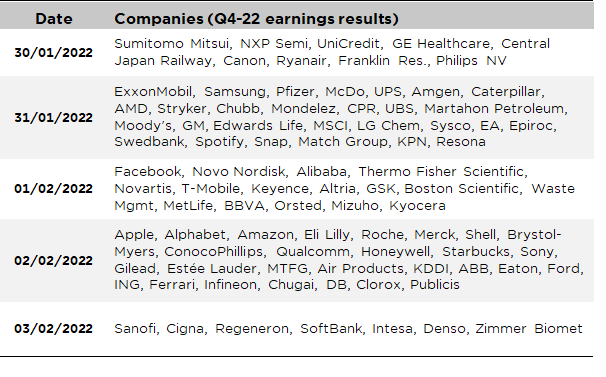

Welcome to February with central banks back in focus this week as the Fed, the ECB and the BoE will all meet and adjust their respective monetary policy/hike their target rate. In addition, we will also get the January global PMI & US ISM indices, the US jobs report, as well as the first estimates of Q4 GDP growth for the major EU economies and the flash reading of German and Euro Area January CPI. So, there will likely be plenty of top-down price actions following these releases. And for those who don’t care much about macro and prefer bottom-up investment approach, there will be a large number of major companies reporting their Q4 earnings’ results too over the next few days, including big tech (Apple, Alphabet and Amazon all reporting on Thursday), big oil (Exxon Mobil, Shell and ConocoPhillips) and major pharma names (Pfizer, Novo Nordisk, Eli Lilly, Merck and Roche) among others. See our non-exhaustive list at the end of this letter.

The Fed’s meeting on Wednesday and the US jobs report on Friday will obviously be the two key highlights of this week macro agenda. While a downshift to a +25bps hike is widely expected now, the focus will be on the “what’s next” messaging, i.e. how many further Fed’s hikes, hints about the terminal rate (what level and when), QT’s evolution and the dividing debate about a potential pivot or a hawkish hold in H2. The focus will be to assess what’s the goal and thus the “precise” reaction’s function of the Fed to decelerating inflation, slowing growth and other external factors such as overall financial conditions or fiscal policy considerations including the potential debt ceiling issue this Summer. In our (consensual) view, we expect two others +25bps hikes in March and May, after the +25bps that will be delivered on Wednesday evening, that would bring Fed Funds target rate to a 5%-5.25% terminal rate. Then, however, we are in the hawkish hold camp as we believe growth will be resilient enough to not lead to a major increase in unemployment rate, while underlying inflationary pressures will somewhat persist (i.e. labor market will remain robust and wages growth won’t slow much). We expect the Fed to tweak somewhat its statement to indicate they are now very close to pausing and thus becoming much more data dependent (“ongoing increases in the target rate” could be replace by “further increases” for example).

Two days after the Fed’s meeting, the January job report released on Friday will likely add new elements to the debate on US monetary policy future trajectory. The consensus expects the change in nonfarm payrolls to slow somewhat to about 150-200k, down from 223k in December, and the unemployment rate to stay close to its historical low of 3.5%. Average (and median) wages growth will also be scrutinized, as well as the participation rate to assess to what extent the Fed’s job is done (or not). There will be many other US labor market-related indicators to crunch this week, including the Q4 employment cost index (tomorrow), the ADP report and JOLTS data on Wednesday, ISM employment sub-indices, the weekly initial jobless claims and Q4 Unit Labor Costs and Productivity on Thursday. Other noticeable US data include the January ISM indices with manufacturing likely continuing to slow down according to our model, but all eyes will be on the services index (Thursday), which surprisingly fell below 50 last month, as well as the Conference Board’s US Consumer Confidence (tomorrow).

While the US, and especially the Fed, have been confronted lately with more encouraging news on decelerating inflation and wages growth but some mixed or conflicting signals about growth, it has been exactly the opposite for the ECB… EZ growth prospects have indeed brightened significantly enough, on the back of lower natural gas prices and China’s reopening, to dissipate recession clouds, whereas recent inflation data have been mixed (decelerating headline inflation vs. stickier core inflation & remaining firm wages growth). Anyway, the ECB is widely expected to deliver a +50bps rate hike on Thursday, taking the deposit facility rate to 2.5%. Here too, with the +50bps already well flagged, investors will look for an eventual dovish biscuit to come thereafter: will Lagarde repeat the guidance for another +50bps hike in March, or not, given the latest developments on the growth and inflation outlook? We think she will, but ECB may also start to indicate that it may become much more data dependent (and thus flexible) after the March’s meeting. We thus expect a +50bps hike this week, followed by another +50bps in March and then at least one (but potentially two) +25bps rate increase in May (and June too eventually) bringing the rate to 3.25% (or 3.5%). ECB will also certainly give investors more technical and operational details on the upcoming QT this week. Before the ECB decision, investors will have some key data to assess the resilience of economic growth and inflation persistence within the Euro Area, such as the first estimate of Eurozone and its major countries Q4 GDP (tomorrow), as well as the January CPI flash reading for Germany and France (also tomorrow), and Eurozone aggregates business & consumer confidence (today), CPI and unemployment rate (Wednesday).

Turning to the UK, the consensus expects also a +50bps hike from the BoE on Thursday, bringing its target rate to 4%. However, it could be somewhat more complicated/less straightforward given the number of moving pieces and the split votes we have had recently. As a result, it’s probably there in the UK where the odds of a dovish surprise seem the highest. The focus will be on the votes of the “major” or more seasoned BoE members (such as Bailey, Pill, Broadbent) to see if there are some signs of dissension on the more dovish side from one of them. Over in Asia to conclude, the key economic releases will be Japan industrial production, unemployment rate and retail sales (tomorrow) and the various China PMI indices released over the week. They are widely expected to rebound, especially the services ones, on the back of the economy’s reopening but to what magnitude may temporarily boost or disappoint investors renewed optimism on China/EM more generally.

Non-exhaustive list of major Q4-22 earnings releases over the week

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.