Happy New Year and Best Wishes for a healthy and investment successful 2023!

I suspect that experiencing a boring year will already do most of the trick. As we start a new year, I have polished my crystal ball in order to make 10 predictions that could shape financial markets and portfolio returns in 2023.

Some may be considered as consensual, other are provocative, many of them won’t happen, while others may seem either obvious or crazy but I still consider worth to keep them in mind. So, there aren’t really “surprises” but more educated guesses, which are linked or bind together, for most of them, to lead to a consistent scenario. Here are the first five. The remaining half will follow next week.

- No hard landing this year: global growth will prove more resilient than expected on the back of China’s reopening, solid consumer expenditures in overall DM (Japan included), but especially in US (strong labor market, pick up in real disposable income, still some savings cushion), manufacturing activity sustained by “industrial policy” of re-shoring, energy transition, security… among others. For sure, real GDP growth will slow but it will look more like the 2001-02 recession than a 2008 repeat.

- US and EU annual inflation rates won’t fall back to central banks’ targets and they will re-accelerate in H2. It’s certainly obvious that annual inflation rate in US and EU will now trend down, perhaps even quite rapidly, in the first half of this year given more favorable base effect, the recent decline in energy prices, ongoing resolution of supply-chain issues, post-covid normalization in good prices and the current slowdown in US and EU economic activity.

However, I suspect that annual inflation won’t come back close enough to the 2% target (especially core inflation). Worse, they may re-accelerate from the Summer onwards as jobs will remain strong, energy prices will rebound on the back of structural issues (the toxic mix of under-investment and challenging energy transition) and more cyclical ones (China’s re-opening, European re-stocking for next Winter, overall low inventories in the US or just a new potential disruptive geopolitical event in an important OPEC+ producer country like a civil war in Iran -about 4mio barrels/day or 5% of global oil production-). - Forget about Fed’s pivot: there won’t be any Fed‘s rate cuts this year. The mix of resilient growth and sticky inflation will lead to a Fed’s hawkish hold. Just look again at the latest Fed’s dot plot. However, the Fed as well as the ECB may provide a backstop to dysfunctional bond markets at some point this Summer -when investors suddenly realize inflation remains an issue and thus there won’t be any cuts, while at the same time US debt ceiling is passionately debated (to say the least) and EU government debt net supply soars. It could be in the form of a temporary and limited QE as BoE did last year after Liz Truss government “mini-budget” plan.

- In this context, US 10 rate will end the year above 4%. While it is and may continue declining in the first part of the year, it will eventually stabilize (above 3%) and then rebound given the 3 points here above. On top of the reasons mentioned here above, I will add that the BoJ monetary policy will also represent an upward risk on global rates, especially Australian and European rates as Japanese investors have been the main foreign buyers of those sovereign bonds.

I strongly believe that there will be other adjustments to the BoJ Yield Curve Control policy before mid-year (Kuroda’s term ends April 8th) either by widening further the 10y fluctuation range, re-center higher the middle of the range or by targeting the 5y instead of 10y. I would eventually change my mind if his successor is Masayoshi Amamiya (Kuroda’s copycat figure) -but it should be Hiroshi Nakaso with free hands to put an end to this unsustainable policy-, and I will definitively change sides if, contrary to my current views, economy falls into a global recession leading to a sharp JPY appreciation. - Within US assets: credit, cash, bonds and equities markets will all end the year with low single digit total returns of less than 6%. Cash will thus offer the best Sharpe ratio and be sacred eventually “King” afterwards. US credit may eventually slightly outperform cash but will underperform US Treasuries and thus ranked 2nd in terms of Sharpe ratio. For the S&P500, it will be a zig-zag year without going anywhere. It should remain on a trading range as I expect (1) it may continue to suffer from excessive valuations relative both to history (when rates were at similar level) and regional peers (Europe, Japan and EM), while (2) there will be basically no EPS growth (EPS will decline at least -10% in hard recession scenario).

After experiencing a good start of the year on the back of a favorable macro narrative, US equities (S&P500) may suffer soon from more adverse micro stories (read disappointing Q4 earnings results on the back of margins compression and negative EPS revision). They will then rebound back to the 4’000 vicinity (as macro backdrop remains supportive), before falling again at some point this Summer (see point 3 here above). The S&P500 will finally end the year on a strong note to finish 2023 just back around current 4’000 level.

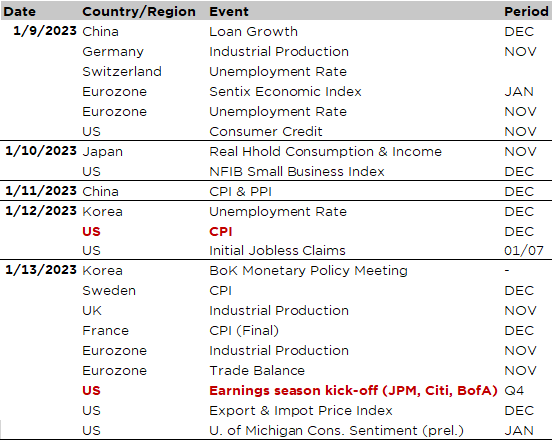

Economic calendar

Welcome to 2023 and fasten your seatbelt… if you can still buckle after the usual end of the year’s celebrations and endless meals. If you are lucky enough to return only today from vacation, this week’s economic agenda will be rather quiet, light and thus easy to digest, in line with a due diet. Moreover, equity and bond markets have started the year with a bang so far… if you exclude the ongoing deflating valuations of US tech/growth mega-cap.

Investors have been indeed reassured by recent economic data, especially the December US job report released last Friday, which fitted perfectly into the supportive narrative of decent or resilient growth (or in any case, still no signs of hard landing) and peaking inflation. US payrolls beat expectations once again (9th straight beat in a row), unemployment rate fell unexpectedly to 3.5% but average hourly earnings rose less than expected (“only” +0.3% vs. +0.4% expected and prior month was revised down to +0.4% from +0.6%). As a result, the yoy increase in wages growth came at 4.6% instead of 5.0% anticipated and 5.1% the prior month. So, while a strong job market with payrolls gains and declining unemployment rate (good news for growth), might -at first glance- encourage Fed’s hawkishness for longer than investors might think, the weaker wages growth ultimately means less reasons for the Fed to hurry up and risk an overtightening to cool down quickly inflationary pressures.

Keep in mind that the Fed doesn’t want per se an increase in unemployment rate or fewer jobs, what it wants is just lower wage growth to 3-4% circa, which will be consistent with its inflation target… Downward trending hourly earnings with continued job creation/strong labor market sound like a soft landing for now. Add to that some narratives chunks of China re-opening and peaking inflation in Europe and you should likely fell a Goldilocks smell! That’s why markets reacted positively in this first days of 2023.

Despite this favorable narrative won’t likely last until year-end, it might extend for a few more days and weeks… especially if the key economic data highlight of this week, namely the US December CPI (released on Thursday), confirms the current trend of declining/moderating inflationary pressures.

Consensus expects the headline print to be unchanged MoM in December and core CPI to gain +0.3%, which will lead to a decline in year-over-year inflation figures to 6.6% from 7.1% and to 5.7% from 6.0% respectively. If these figures don’t surprise on the upside, it will likely seal the deal for a +25bps hike by the Fed -instead of +50bps- at its next meeting on February 1st.

Other economic data to keep an eye on this week include the US NFIB Small Business Index (tomorrow), the China CPI (Wednesday) and the University of Michigan consumer sentiment (Friday). Central bank speakers will be in focus too, including Fed Chair Powell and BoE Governor Bailey, who will both appear at Riksbank’s International Symposium on Tuesday, among others. Last but not the least, earnings season will kick off on Friday with the release of a number of US financials Q4 results (Citi, JPM and BofA).

This is a marketing communication issued by DECALIA SA. It is neither directed to, nor intended for distribution or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. The information and data presented in this document are not to be considered as an offer or invitation to buy or sell any securities or financial instruments nor to subscribe to any services. The information, opinions, estimates, calculations etc. contained in this document reflect a judgment at the original date of publication and are subject to change without notice. Investments in any securities or financial instruments may not be suitable for all recipients and may not be available in all countries. This document has been prepared without taking account of the objectives, financial situation or needs of any particular investor. Before entering into any transaction, investors should consider the suitability of the transaction to individual circumstances and objectives. Any investment or trading or other decision should only be made by the client after a thorough reading of the relevant product term sheet, subscription agreement, information memorandum, prospectus or other offering document relating to the issue of the securities or other financial instruments. Where a document makes reference to a specific research report, the document should not be read in isolation without consulting the full research report, which may be provided upon request.

Unless specifically mentioned, charts are created by DECALIA SA based on FactSet, Bloomberg or Refinitiv data.