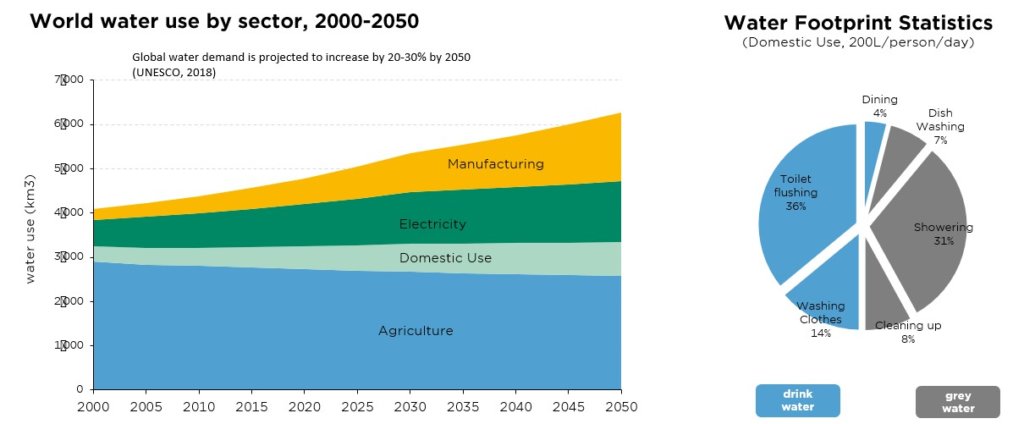

•Limited supply and increasing demand: such are the dynamics of the water market

•Climate change only worsens the picture, heralding shortages and conflicts

•The need -and investment opportunity- for better infrastructure/efficiency is great

With the war in Ukraine, access to energy and agricultural commodities is an immediate worry and, quite understandably, the subject of much media focus. Longer-term, though, it is another resource that could go lacking – and one that is vital not only for the functioning of the economy, but also for the very survival of mankind. We speak here of water.

Agriculture today accounts for some 70% of global freshwater usage, with its demand to double by 2050 in order to be able to feed (and clothe) the growing planet population. Water supply, meanwhile, is not unlimited – at least not in all regions. Some of the most important crops in terms of trade value or volumes, wheat, rice and cotton for instance, grow in countries that are challenged for water. Add in the climate change factor and the water supply-demand equation can only get worse. Indeed, it is estimated that nearly half of humans will live in water-stressed areas by 2030. Which means the potential for conflicts or social unrest, and a higher price for what is generally still viewed as a public good.

This higher price tag should, in turn, encourage investment in water infrastructure (particularly in developing countries) and support efforts to reduce wastage and pollution, respectively increase the water efficiency at both the production and consumption levels. All of these being interesting avenues for equity investments.

Pureplay companies are few and far between, but we would be amiss not to mention the recently combined Veolia-Suez behemoth, with almost 50% of its activity in water management and a presence across most continents. Other notable actors are Advance Drainage Systems, active – as the company puts it – over the full “lifecycle of a raindrop” (capture, conveyance, storage and treatment), Evoqua Water Technologies, a specialist in water and wastewater treatment, NX Filtration, a manufacturer of nanofiltration membranes, or Xylem, whose technology solutions strive to “make water more accessible and affordable”. A word also on Geberit, the Switzerland-based global leader in sanitary products, of which many designed to save water through more efficient processes.

More generally, from an ESG perspective, the fact that water is increasingly – and correctly – being viewed a material risk to business need also be better recognised in investment frameworks. We should add that this risk category encompasses much more than just the question of physical access to water. Regulatory developments must also be monitored, as well as reputational issues. Which is why a number of companies, and not only in the agricultural space, are busy setting up water stewardship programmes – adopting more regionally diverse procurement strategies and engaging with suppliers to mitigate sourcing risks. And also why the PRI, a UN-supported network of investors, recently coordinated a USD 6 trillion engagement to improve disclosures related to water.

Sadly, World Water Day, on 22 March, went almost unnoticed this year, just coming out of the Covid pandemic and amid the developing Ukrainian tragedy. Let us hope this will not be the case in 2023 and onwards…

Written by Andrea Biscia, ESG Analyst & Junior PM

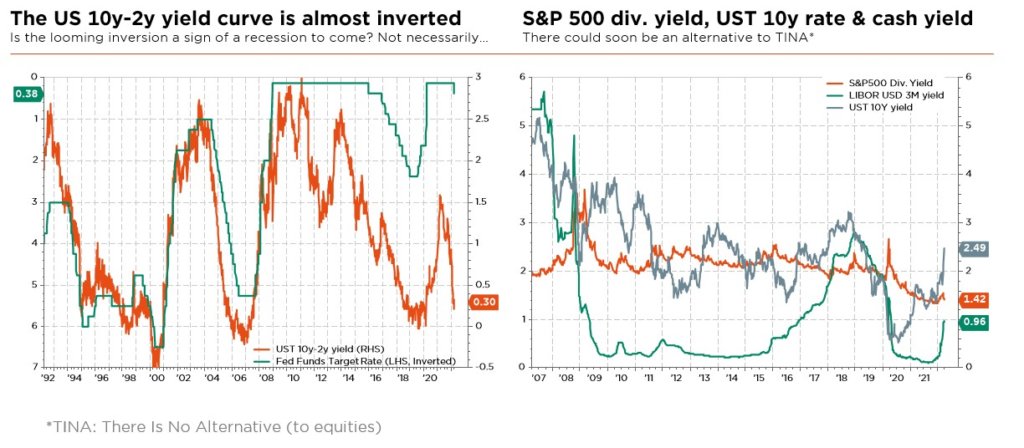

The good news? An alternative to TINA* lies ahead

The sweet goldilocks macro cocktail sipped by global financial markets since mid-2020 has now turned sour, with mounting stagflation concerns, hawkish central bankers and the ongoing war in Ukraine. Adding to its bitterness, Covid fears have made a notable comeback in China, with a resurgence of cases driving new large-scale lockdowns, hence reviving global supply chain disruption concerns and thus likely to exert further upward pressure on prices worldwide. Meanwhile, stock markets seem to be loving it: equities have rebounded strongly, climbing a wall of many big worries.

Admittedly, one could argue that equities figure among the “least bad” alternatives in this context, especially since much bad news has been priced in, valuation multiples are well off their highs and, to sweeten things a little more, we do not foresee another global economic recession at this point. That said, the unpredictability of Russia’s leader and the extent of knock-on effects for the rest of the world remain key – and difficult to assess – near-term swing factors for both economic and corporate earnings growth. In addition, all the aforementioned moving parts have reduced near-term visibility and deteriorated the growth-inflation mix, leading us to adjust our macro scenario and the outlook for risky assets (higher risk premia).

By and large, the same can be said of bonds, with rates having again edged higher (despite revived geopolitical concerns and subsequent downward revisions to growth), reflecting both a higher inflation risk premium and the upcoming central bank hiking cycle, while credit may continue to suffer from broadly deteriorating financial conditions. Unfortunately, not only do bond yields still stand below projected inflation in many developed markets, but they are also not bringing any decorrelation effect to balanced portfolios in this reverse-goldilocks scenario.

With that in mind, at the portfolio level, we maintain our neutral stance on global equities and steep bond underweight. While adjusting portfolios’ positioning to mounting stagflation risks (by trimming European equities, reducing credit exposure across the board, adding to gold & commodities, and favouring US Treasuries over Euro government bonds), we have also finetuned our recommended regional equity allocation, upgrading the UK to a slight overweight and downgrading China to a slight underweight. Importantly, we continue to emphasise the need for a more benchmarked stock selection and balanced multi-style all-terrain portfolio approach in this uncertain market environment.

More generally, we have turned more cautious on Chinese assets (including sovereign bonds and the CNY, both downgraded to a slight underweight) on the back of revived geopolitical tensions between the West and the East, the resurgence in domestic Covid cases, a less appealing relative yield and a further regulatory overhang (ongoing crackdown on select industries and risk of Chinese ADR delistings).

Elsewhere, we stick to our slight overweight of gold and other (industrial) materials, given the favourable backdrop and supportive supply/demand dynamics. Finally, we reiterate our negative tactical view on the EUR vs. USD. A more patient ECB, trapped between a rock and a hard place, will likely prove a headwind for the single currency. Elsewhere, we remain comfortable on commodity-currencies such the AUD or CAD (plays on industrial metals, attractive rates, improving terms of trade) as well as the CHF, supported by still solid structural fundamentals.

Written by Fabrizio Quirighetti, CIO, Head of multi-asset and fixed income strategies